What does the latest GRIT report mean for qualitative market research?

The GRIT (Greenbook Research Industry Trends) report is undoubtedly one of the leading and most comprehensive surveys of the market research industry, showing where the industry is now, where it’s going in the future and how you can adapt to these changes. Published annually since 2011, this latest version looks at Q3-4 of 2017 and gives a meaningful and reliable snapshot of the global market research industry that you can use as a strategic planning tool for the year ahead.

Here we look at some of this year’s biggest industry trends for qualitative market research according to the latest report.

Qualitative versus quantitative

The latest GRIT report is based on 15,333 interviews across 75 countries - and according to the data collected, 60% of respondents conduct quantitative research whilst 35% conduct qualitative market research. Whilst online surveys are the go-to method for quantitative research, in person focus groups still rule the roost in qualitative market research with 26% of respondents using them and 15% conducting in person IDIs. Tele depths also remain a hugely popular technique in the qualitative market research world; despite being seen as a dated technique, they are actually the third most popular method with 11% of those asked using this methodology. Considering we live in a technology obsessed world, these results are somewhat surprising - after all, who would have predicted that the telephone would still play such a crucial part in the market research industry in 2017?

Adoption of emerging methods

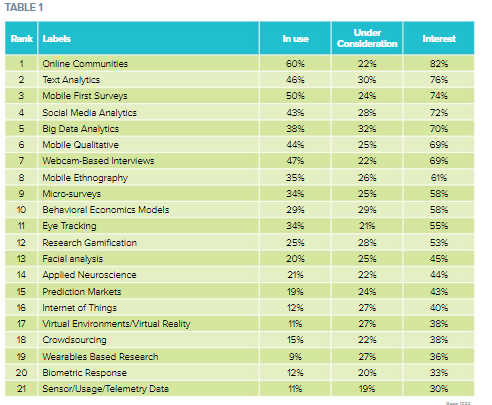

If you have a look at our review of last year’s GRIT report, you’ll see that very little has changed in the past year: online communities and mobile surveys were the two reigning approaches then, and this trend continued well into 2017 with 60% of respondents using online communities and a combined 82% saying they are either currently using them or considering doing so. After online communities, the next most popular methods are quantitative and include text analytics (76%), mobile first surveys (74%), social media analytics (72%) and big data analytics (70%) followed by three qualitative options - mobile qual (69%), webcam-based interviews (69%) and mobile ethnography (61%) (see Table 1). With such a large number of companies using or considering using big data, over 40% of respondents viewing big data as an industry game changer and predictions that within two years the majority of surveys will be augmented or appended with big data, it’s interesting to see the continued strength of qualitative methods in a data-centric world.

Stability over change

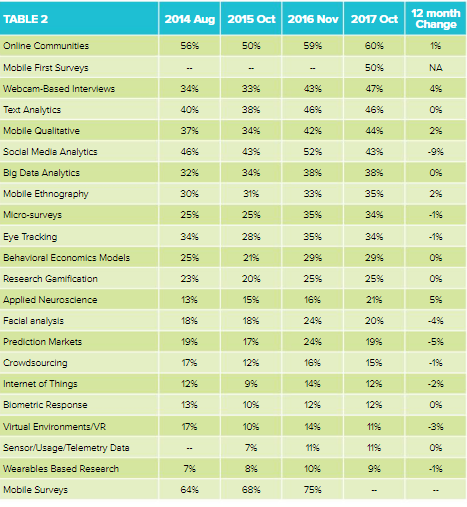

Although this year’s report highlights some small changes in the last 12 months, then, actually very few of them are significant with popular methods holding onto their crowns for another year and small niche techniques such as virtual reality and wearables based research sticking with their small groups of dedicated users at the lower end of the league table (see Table 2). Overall there’s been a message of stability worldwide in general over the past few years; although there are some differences by region, the main trend from the report is that the advanced market research world is essentially a similar place across the globe.

What’s next?

Respondents were also asked about any other emerging technologies they are thinking about using in the future, with the report finding that artificial intelligence, video analytics, automation and multiple platforms are of far larger interest to buyers than suppliers, with 13% of those asked saying they would consider using AI in research and 5.2% considering video analytics. There are some exciting approaches that haven’t quite taken off yet, too, such as virtual reality and neuroscience which despite being a hot topic of discussion for many years was actually considered by 0% of those asked. Although new methods in general haven’t proved that popular in recent years (with the exception of online communities which has experienced double-digit growth since 2015), this year 4% of respondents mentioned AI which is up from 0% in 2015. This suggests that although the industry as a whole is slow on the uptake, artificial intelligence will most likely have a greater impact than any other new techniques in the coming years, with analysts expecting near total-wide industry adoption over the next decade.

Conclusion

In conclusion, the last few years have been a pretty steady time for the advanced research world. Yes there have been some small differences year-to-year, but the overall pattern is one of stability. What is the main thing to take out of this year’s report, then? Well firstly, with the ongoing adoption of online communities and mobile surveys, if you’re not yet utilising these technologies in your qualitative market research, now is the time to start doing so to ensure you keep up with the industry and don’t get left behind. Secondly, whilst emergent techniques such as virtual reality and artificial intelligence aren’t taking the market research industry by storm just yet, by keeping an eye on these new exciting techniques whilst at the same time utilising some techniques from the middle of the table, you can ensure you’re ahead of the game throughout the next year and ready for what the future has in store.

Make sure you keep up with the competition. If you’d like to find out more about how to conduct a successful market research online community, download our helpful guide here.