Your guide to conducting feasibility testing

Essentially, a feasibility test is a thorough assessment carried out prior to starting any market research project to get an idea of how achievable the project is. Done properly, it will give you the foundations you need to build a successful qualitative market research project.

From prior experience in the research area to potential locations and chosen methodologies, a thorough feasibility assessment will tell you just how viable your chosen sample is before you invest valuable time and money. Although the principle of feasibility will always stay the same, the options available to us to implement accurate feasibility testing is constantly evolving with the help of technology.

This post will help you utilise technology to conduct your own feasibility testing. With a wealth of information readily available to use at the touch of a button, we must harness this within our qualitative market research recruitment. Read on to find out how you can conduct your own feasibility testing utilising today’s technology…

Do your research before you begin a feasibility test

One of the first steps to a successful feasibility test is to widen the scope of your research. Are there sources of secondary research you could utilise to inform your thinking? And do any of these additional sources help you to drill down into the demographic you are targeting? Look at any previous projects you or colleagues or peers have conducted. What can you learn from these?

Resources that provide insights into consumer trends can also be very useful as they offer industry specific statistics and market intelligence that can help you to make informed decisions. Google Trends is a tool that you can use to gain this information as it offers topical data at certain times of the year and how this fluctuates accordingly. This resource could be invaluable to brands looking to conduct research about a seasonal clothing line.

Another Google tool that can prove useful for your feasibility testing is the Google Keyword Planner. Often this tool is utilised by marketing professionals, but it can prove useful to your qualitative market research too. You can search by phrases that your demographic may type into search engines, which will give you a better indication of how many people in the UK (or country of your choice) are also searching for these terms. For example, you could search for ‘Buy Amazon Echo’which would give you 390 monthly searches per month indicating that it is a fairly popular term.

In addition to this, Consumer Barometer with Google can provide detailed information on consumer usage trends. For example, it can provide statistics on the number of consumers using the internet, their shopping habits and their online media consumption. Not only that, but it goes one step further to break down this usage into demographics such as digital mums and millennials. This tool also has a graph builder function that enables you to ask different questions in accordance with the data. Google then programmes this into a handy graph.

Example questions that you can ask which will help you conduct your own feasibility include:

Example questions that you can ask which will help you conduct your own feasibility include:

- How often do people watch online videos?

- What devices do people use for their research?

- On what type of websites do people make their online purchases?

- For what daily life activities do people use their smartphone?

These types of resources are invaluable to feasibility assessment as they provide a wealth of information without intensive searching, and what's more, they are free. The following resources are also a great place to look for new perspectives, demographic statistics and fresh insights into market intelligence:

Be realistic with your audience

Next up, you need to look at your target audience and make sure you’re considering the right methodology for your respondents. For example, a market research online community may not be the best method for over 75s. Always use statistics to back up your choices – for example, online statistics may show that there is a lower rate of over 65s using smartphones which would indicate that mobile research is more than likely not the best methodology for this demographic.

If you are trying to reach out to an audience with low incidence rates, MROCs are probably a better bet than location-specific focus groups. There might well be some qualifying criteria that respondents have to meet which is less important than others. It’s also a good idea to identify the nice-to-have criteria from the must-have criteria early on so you know where you can afford to be flexible and where you can’t.

Manage clients' expectations

Incidence rates will naturally vary depending on what audience you are looking to reach, so you should be willing to adjust your methods accordingly. For example, if you are trying to find people living in London, aged between 35-55 years who own an iPad, you’re going to come across a lot of potential respondents.

However, if you need to find people living in London, aged between 35-55 years who own an iPad, earn over 60k per annum and commute to work by foot you’re going to have to adopt a more specific and targeted approach. Rare and unusual populations are going to present more challenges when recruiting and may require greater creativity. Because of this, it may cost more to recruit these populations. For example, the incentives will likely have to be higher to encourage participation.

Due to the time it may take to recruit rare and unusual populations, you should factor more time into your project to assess the feasibility and the recruitment of these people, so ensure that you plan ahead!

Something else to bear in mind is that, even if you find participants who meet all of your qualifying criteria, they might not want to participate in your research. You’ll need to be realistic when considering sample sizes to make sure there are no nasty surprises further down the line.

Utilise social media

Another great way to conduct your own feasibility test is through social media, which when used correctly can open up amazing opportunities in regards to finding the right participants for your research.

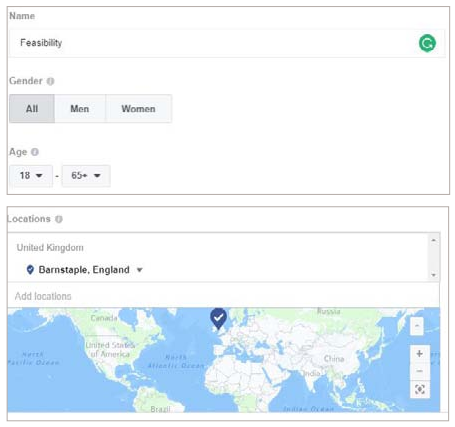

Platforms such as Facebook gives researchers the power to post adverts to target people that meet specific criteria. This targeting can be based on demographic information such as age, gender, lifestyle, education, relationship status and job role as well as targeting based on page likes, location, languages that people speak, brand preferences and past purchase behaviour and methods.

It will then even give an estimated audience size based on the criteria you have selected and the amount you are willing to spend, so you know exactly how many people you are reaching.

Other ways to utilise the power of social media to help with feasibility assessment include joining LinkedIn groups. This will enable you to view the current discussions that are ongoing in the industry you are looking to research. You could also join in with LinkedIn discussions to directly reach out to specific people you may want to include in your research.

Twitter can sometimes be overlooked, although when utilised correctly it can make a great impact on your feasibility test. You can search for specific hashtags that relate to a product or service, or even an industry that you are conducting research in. This provides complete visibility to the types of users that are talking about these areas and also the sheer volume of people that are interacting with these topic areas online. Utilising this type of information is invaluable to your feasibility as it will help you to understand how many people in this area could be relevant participants for your study.

Reach out to recruitment suppliers

Lastly, it’s worth reaching out to potential recruitment suppliers to see what experience they have in the area you are recruiting in and if they can help. Perhaps you are planning research surrounding a product with a low incidence rate?

Well, with years of experience behind them, they are the ones to ask for advice! If you do decide to approach recruitment suppliers to help, make sure you are open and honest with them about the objectives of your study and be willing to listen to suggestions on how you could find participants and improve feasibility.

Don’t be afraid to ask for more information if you think you need it – whatever type of audience you are looking to reach, the likelihood is that they have some form of experience that you can learn from.

If you have been asked to conduct a qualitative fieldwork project and would like to find out more about how to generate the best possible results, why not download your guide to find out more?

.webp?width=500&name=MROCS%20GKA%20(1).webp)